Laying awake at night stressing over piles of bills, credit card statements, and overdue loan payments is an all too common occurrence for many debt-ridden people. Statistics show that total household debt rose by $212 billion in Q4 2023 to reach $17.5 trillion. While debt has become an increasing reality for much of the population, it does not have to lead to despair and sleepless nights.

In reality, individuals have more power than they may realize when it comes to taking control of a difficult debt situation and working toward financial freedom. While it demands diligence, short-term sacrifice, and a new perspective on spending habits, creating a sustainable debt repayment plan is entirely achievable!

In this article, we’re going to see 10 powerful, little-known strategies for tackling debt and building an intentional repayment plan customized to your situation.

I. Embrace a Budget-Oriented Lifestyle

Crafting a comprehensive budget serves as the foundation for managing finances effectively during debt repayment. Regularly monitor and adjust the budget to align with debt repayment goals without compromising essential living standards.

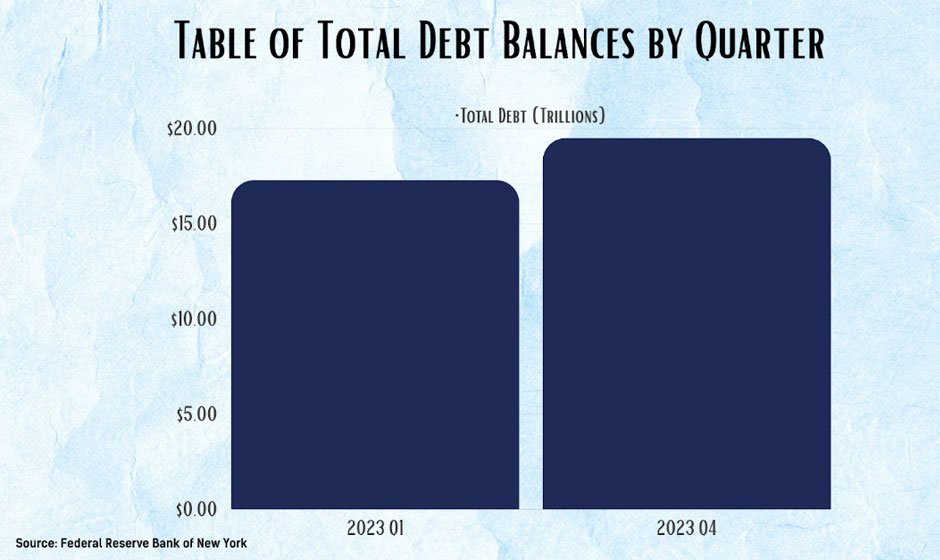

Implementing a budget is crucial for managing your finances during debt repayment. Consumer debt has grown significantly over recent quarters, as shown in this table of total debt balances:

Table of Total Debt Balances by Quarter:

With total debt on the rise, embracing budgeting and expense-tracking will provide visibility into where your money is going and help control spending. Analyzing the past 3-6 months of expenditures can reveal areas where cuts may offer savings that can be redirected toward debt.

Analyze your spending habits over the past 3-6 months to identify areas where you can cut back, such as dining out, entertainment, subscriptions, or other discretionary purchases. Reducing these variable expenses frees up cash that can be redirected toward debt payments.

Pay close attention to essential spending as well, like housing, transportation, groceries, and utilities. Look for ways to lower costs by negotiating rates with cable/internet providers, switching auto insurance carriers, moving to a lower-rent apartment, or buying generic grocery brands. Every dollar saved is another dollar towards debt freedom.

Establish clear budget categories, set limits, and carefully track spending to turn this into sustainable positive money management habits, critical for long-term financial well-being.

II. The Debt Avalanche Method

The debt avalanche method prioritizes paying down debts with the highest interest rates first, regardless of balance size. List all your debts by interest rate, from highest to lowest. Dedicate as much money as possible towards eliminating the debt at the top of your list before moving on to the next one. This saves money on interest charges over time compared to other approaches.

For example, if you have $5,000 in credit card debt charging 25% interest and $8,000 in student loans charging 7% interest, the debt avalanche method dictates focusing on paying off the credit card first before tackling the student loans.

To effectively implement the debt avalanche method:

- Make a list of all debts and associated interest rates

- Rank debts from highest interest rate to lowest

- Calculate minimum monthly payments for each debt

- Designate any extra monthly cash towards the highest-interest debt after making minimum payments on all accounts

- Once the highest rate debt is cleared, roll the amount previously used for its minimum payment into the next highest rate debt payment

- Continue this approach until all debts are repaid

This strategic repayment order means fewer interest charges over time compared to paying down by total balance amounts. Stay motivated, knowing that every extra payment brings you closer to saving money and becoming debt-free

As you develop a debt repayment plan, be aware that there may be special senior assistance programs available if you are over a certain age, such as 65. These programs provide helpful resources for older adults struggling with debt, including customized advice and consolidated payments. Check out senior assistance programs that you may qualify for.

III. The Debt Snowball Approach

For those who thrive on quick wins to stay motivated, the debt snowball approach offers a psychologically rewarding path to debt freedom.

Rather than focus on interest rates, the debt snowball method prioritizes paying off your smallest debts first regardless of interest rate. List your debts from smallest balance to largest. Attack the smallest debt with vigor while making minimum payments on all others.

Once the first debt is cleared, continue making minimum payments on all remaining debts while rolling the amount previously used for the newly paid-off debt’s minimum payment directly into the next smallest balance. Repeat this process as each progressively larger debt is paid in full until all your debts are eliminated.

This Debt Repayment Plan strategy provides motivation through early small wins. Over time, as larger debts are paid off, the snowball effect kicks in to accelerate your progress toward becoming debt-free. To execute the debt snowball approach efficiently:

- List unpaid debts from smallest balance to largest balance

- Make minimum payments on all debts

- Target any extra available cash each month towards paying off the smallest balance debt aggressively

- Once a debt is fully paid, redirect the minimum payment amount to boost payments on the next smallest debt

- Repeat Debt Consolidation Strategies until all debt balances are repaid in full

Celebrate each small debt victory while staying focused on the next target to maintain positive momentum toward financial freedom.

The debt snowball method can be an effective debt repayment strategy for those needing inspiration through visible progress. Pairing this approach with an airtight Cut Unnecessary Expenses and serious budget cutting can accelerate your Debt Freedom success.

IV. Utilize Balance Transfer Credit Cards

Balance transfer cards offer a 0% introductory rate for new purchases and balance transfers for 12-21 months. Transferring high-interest credit card balances to one of these cards reduces interest costs substantially during the promotional period, allowing more money to go toward paying down principal debt.

When leveraging balance transfer credit cards strategically, be sure to:

- Carefully compare balance transfer offers to pick the best terms and longest 0% intro rate period

- Pay close attention to balance transfer fees, which usually range from 3-5% of the balance

- Never charge additional purchases to the card after transferring a balance

- Focus on paying down the full transferred balance well before the intro rate expires

- Review standard purchase/balance APR rates and make sure you have an exit repayment plan to avoid surprises

As long as you have a solid budget and repayment plan in place, utilizing balance transfer cards tactfully during a debt reduction campaign provides temporary relief from burdensome interest costs. This equates to faster debt elimination progress.

V. Harnessing the Power of Debt Consolidation

While balance transfer cards offer a short-term fix for high High-Interest Debt rates, consolidating multiple debts into one centralized loan provides a long-term solution to streamline your repayment efforts.

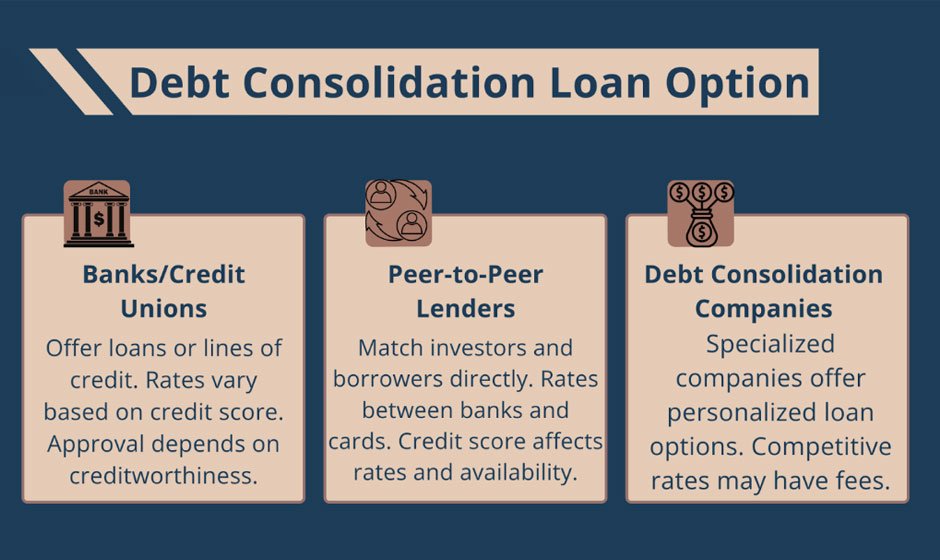

The first step is to carefully consider available consolidation options:

Analyze and compare total origination fees, average APR ranges, loan term length options, credit score requirements, borrower reviews and complaints, and overall customer service when deciding on the best debt consolidation loans for your needs.

Then calculate hypothetical monthly payments and total interest costs for each option over the loan term to determine the most cost-effective consolidation loan provider for your situation. Consolidating multiple debts accelerates repayment by simplifying your financial obligations into one monthly payment.

VI. Increase Income Through Side Hustles

As you streamline your debts, boosting your income through side hustles can accelerate your repayment plan, turning your debt-free goals into reality sooner.

Bringing in supplemental income from a second job or side gig provides extra cash flow specifically earmarked for debt payments. Options like ride-share driving, food delivery, website design, online tutoring, or dozens of other freelance platforms offer flexibility to earn at your convenience. Setting income goals and dedicating these funds towards debts every month expedites the repayment timeline.

VII. Cut Unnecessary Expenses

Complementing your increased income with a careful review of your spending can magnify your debt repayment efforts. Identifying and cutting unnecessary expenses is key to freeing up more funds for debt reduction.

Take an objective look at all non-essential spending over the past 3 months including dining out, entertainment, subscriptions, luxury items, and more. Can you temporarily cut back or eliminate any expenditures? Every dollar saved is another dollar towards debt freedom.

Additionally, look for opportunities to lower monthly bills through actions like negotiating rates with cable/internet providers, switching auto insurance carriers, or moving to a lower-rent apartment.

VIII. Negotiate with Creditors

Armed with a leaner budget and extra income, you’re in a stronger position to negotiate with creditors for better terms on your remaining debts.

Call each creditor and clearly explain your financial situation and improved ability to repay thanks to increased income and lower expenses. Be prepared to share details to add credibility. Request lower interest rates or modified payment plans; many creditors are willing to negotiate flexible options to ensure they receive payment over default. Consider involving professional credit counseling services for assistance with larger, more complex debts.

IX. Automate Your Debt Payments

Successfully negotiating your debt terms is just the beginning. Automating your debt payments ensures that you consistently meet your newly negotiated obligations without fail.

Set up automatic monthly payments through your bank or creditor websites so principal and interest payments are paid on schedule without manual effort. Automation prevents late fees, keeps accounts in good standing, and maintains a positive payment history.

Closely monitor bank balances and due dates during initial setup to prevent overdrafts. As the amount owed declines over time, the automated process adapts seamlessly.

X. Monitor and Celebrate Progress

While automation takes care of consistency, actively monitoring your progress and celebrating milestones keeps you engaged and motivated throughout your debt repayment journey.

Review debts, interest charges, additional payments, and decreasing principal monthly or quarterly. Track and visualize progress in tools like spreadsheets or budgeting apps. Establish mini-goals and milestones and celebrate the wins along the way!

Outlining motivated, meaningful rewards for early goals reached reinforces positive momentum. As you pay down debts, channel that growing energy into the next target. Soon multiple debts are cleared; maintaining focus puts the final debts in your sights and debt-free living within reach.

Frequently Asked Questions

How do I prioritize which debts to pay off first if I’m using multiple strategies?

Evaluate factors like total balance, interest rates, income stability, and personal motivation level. Those struggling with high-interest credit card debt but need early wins for morale may benefit from a hybrid snowball/avalanche approach – clear one small card quickly, then attack the highest-rate debt before moving down the list.

Is it possible to improve my credit score while repaying debt?

Absolutely! Staying current on payments, decreasing credit utilization over time, and reducing total debts can significantly boost your score by 50-100 points over a 12-24 month focused repayment campaign. Avoid taking on new debt during repayment efforts to maximize positive impacts.

Should I still save money while focusing on debt repayment?

Maintaining a modest emergency fund of $500-1,000 provides stability and prevents acquiring additional debt to cover unexpected expenses; critical during aggressive debt repayment. Contribute small amounts monthly, even while directing most resources towards paying down debt at a rapid rate. The key – save conservatively while staying intensely focused on debt elimination.

How do I know if my current repayment plan is sustainable?

If you find yourself struggling each month to make the payments you planned or going further into debt, your plan is likely not sustainable. A sustainable plan has payments you can afford each month while covering necessities.

How do I prioritize which debts to pay off first?

Generally, you’ll want to pay off high-interest-rate debts first while making minimums on all other debts, then focus on the next highest interest-rate debt. This “debt avalanche” method saves you the most on interest costs.

Should I use a debt consolidation loan to repay my debts?

Debt consolidation can make repaying debt more manageable by giving you just one payment at a lower interest rate. But these loans mean taking on more debt, so make sure you can handle the new consolidated loan payment responsibly.

Will balance transfer credit cards help me get out of debt faster?

Balance transfer cards offer 0% interest for 6-21 months, allowing you to pay more towards your remaining debts faster during this time. Just be sure you pay the full transferred balance before the 0% rate expires.

How often should I revise or review my debt repayment plan?

It’s important to review your debt repayment plan at least every 6 months. If your income goes up or you eliminate one of the debts, you may be able to allocate more towards the remaining debts. Life changes may require changes to the plan.

Can I ever pause my debt repayments?

It’s best not to pause repayments unless absolutely necessary due to job loss or emergency expenses. Pauses should be short-term if possible. If you do pause, communicate with lenders, and be sure to restart payments ASAP.

Are debt management plans only for people struggling with repayment?

No – anyone can benefit from advice and structure through a formal debt management plan from a non-profit credit counseling agency. These plans help organize payments and negotiate rates. They suggest sustainable payment timelines too.

Can I create a debt repayment plan on my own or do I need to pay someone to do it?

You absolutely can create your own customized debt repayment plan yourself for free. List out all debts, interest rates, minimum payments, and available extra monthly cash flow. Then allocate based on your preferred payoff strategy.

What percentage of my disposable income should go towards debt repayment?

Financial experts suggest spending between 20-30% of your disposable income (income after covering necessities like rent and food) on debt repayment. Going much higher may mean unsustainably shorting other important spending categories.

How long will it take me to become debt-free?

The length of time it will take depends on factors like your total debt amount, interest rates, and how much disposable income you can allocate monthly. Use a debt repayment calculator to estimate timelines. Most plans range from 1-5 years.

What should I do once I have paid off my debts?

Congratulations once you reach debt freedom! Be sure to continue the good financial habits you used in your repayment plan like budgeting and saving each month. Build up a liquid emergency fund, contribute to retirement, and consider investing any surplus funds.